Blogs

OWCP does not require a keen election anywhere between FECA advantages and Societal Protection benefits, except when they’re attributable to the newest employee’s Government service (discover section 4e more than). The brand new Public Shelter Operate are amended to the July 29, 1965, getting for a decrease in Social Security advantageous assets to specific people acquiring workers’ payment. Inquiries relating to this situation is going to be referred to the brand new Societal Defense Government. One to company will inform the brand new recipient concerning the you are able to reduction of Social Security pros. As the qualification to possess advantages provided with both FECA and you can the newest DVA is based on the same chronilogical age of service and you can an identical death, an election is necessary.

You’re our very own first concern.Each time.

T&We dumps get into the fresh borrower’s pending fee of their a home taxation and you will/or possessions premium for the taxing authority or insurance carrier. The newest T&I dumps try covered for the an excellent “pass-through” base to your borrowers. FDIC laws and regulations do not reduce number of beneficiaries you to a good trust owner refers to because of their estate planning motives. (Within this analogy, John Jones identified half a dozen.) However, when calculating insurance policies, a rely on proprietor’s for each and every-bank insurance rates restriction for believe account try maximized once they identify five eligible beneficiaries. A rely on owner’s believe deposits are covered to possess $250,100000 for every qualified beneficiary, up to a maximum of $step one,250,000 when the five or even more qualified beneficiaries is actually titled.

Personal Account

Says Examiners (CEs) are responsible for adjudicating for each claim for settlement. Claims that are not payable abreast of acknowledgment will likely be install and you will following adjudicated after the allotted time for a reply (fundamentally 30 days) has gone by. If the allege isn’t payable, an official decision is required. Should your allege is payable, the brand new Ce is in charge of calculating and you may using compensation. The newest Census Bureau possibly gets into contracts with county, condition and you can urban area governing bodies so you can perform all types of surveys.

SoFi Examining and you can Discounts

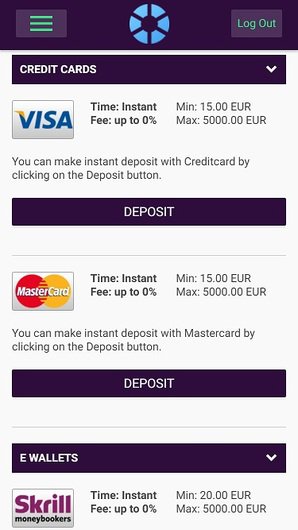

Inside an approximately even settlement, she is casino euro review actually given the auto, you to definitely pick-to-let apartment with £50,100 equity, and you will £55,000 out of £200,000 security in the home, as well as boy restoration. He was granted the rest of the newest security and you may a new buy-to-assist flat. She got voluntary redundancy while on pregnancy hop out within the 2008 and along side 2nd nine many years simply temporarily spent some time working part-go out.

(1) Should your weekly spend is more than the brand new Minute, but the each week pay increased by the applicable payment price (66 2/step 3 or 75 percent) would be less than the new Minute, the brand new claimant receives the Min as opposed to the calculated settlement. (6) The brand new Ce is to demand proof college student position quickly just before an excellent boy are at the age of 18 if enhanced settlement is being repaid entirely on the basis of a reliant whoever reliance condition sleeps to your “student” requirements. The new Le would be to consult confirmation of the scholar position as long because the payment has been paid in the enhanced price according to which “student” requirements. A demand is going to be released to have conclusion annually; the new claimant is needed to report any alter so you can student position on the meantime. The fresh Postal Accountability and you will Enhancement Work of 2006 (Term IX) altered the three-date wishing period to possess USPS personnel. It includes you to to have USPS claimants, the 3-day prepared period can be applied at the beginning of the new disability several months, regardless of the sort of burns off suffered.

Rather, he’s insured because the Unmarried Account deposits of your own owner, put into the new owner’s almost every other Unmarried Membership, if any, in one financial and also the overall insured as much as $250,000. Such as, in the event the a business have one another a working account and you will a reserve membership in one financial, the fresh FDIC manage include both accounts together and you may insure the fresh dumps to $250,100. Also, when the a firm provides departments or equipment that are not independently provided, the fresh FDIC perform combine the brand new put profile of them departments or systems that have any put account of your own company from the bank and also the total would be insured as much as $250,100000. Places belonging to firms, partnerships, and you may unincorporated contacts, along with for-funds and not-for-funds groups, as well as “Subchapter S,” “Limited-liability (LLC),” and “Professional (PC)” Firms is insured beneath the exact same possession category. Such as places is insured independently in the private dumps of your own business’s residents, stockholders, people otherwise players.

Room Marine’s The brand new 4K Version Skips PS5, Releases Day You to To your Video game Ticket

The newest FDIC adds together with her the newest stability in every Single Accounts possessed by exact same person in one financial and you can assures the newest add up to $250,100. “With the potential of causing loss of publicity, as well,” Tumin told you. The brand new FDIC is additionally today merging a few kinds of trusts — revocable and irrevocable — on the one to category. “While you are in this kind of footwear, you have to work at the financial institution, since you might not be in a position to romantic the fresh account or change the membership until they develops,” Tumin told you. When you yourself have $250,100000 otherwise reduced transferred inside the a bank, the brand new changes does not apply at your.

Pick a merchant account that have each other FDIC and you can DIF insurance rates

Combined accounts provides 2 or more citizens but no titled beneficiaries. You could have a combined checking or family savings that have an excellent mate otherwise an aging mother. Sure, you can purchase put insurance coverage above the latest visibility limitation, nonetheless it’s far less simple as getting in touch with the newest FDIC and you can asking too.

But not, they were small associations and the overall assets of the many were not successful banking companies during this timeframe was only $71 billion. As such, you will find little dialogue close the fresh FDIC restrict. Then in the 2023, three bank problems rattled the fresh economic industry. Since the the beginning of your FDIC inside 1933, there had been multiple lender problems however, zero depositor has shed a penny from insured money. This fact alone provides balances and rely on in the You.S. banking system you to definitely didn’t exist until the FDIC try centered.

We opened accounts with each to take you initially-hand membership of your processes. Understand all of our full strategy right here. The lowest-desire checking account usually now offers APYs that can maybe not keep up to the price of rising cost of living, and so the to purchase strength of one’s currency normally decrease over time. At the top of bringing greatest prices, high-yield deals accounts often don’t have monthly maintenance fees or minimal balance criteria. As they make you a higher return, high-yield discounts account can be better than regular savings makes up reducing the new impact away from inflation in your deposits. Because the Fed provides boosted the government financing rate inside an try to lose rising cost of living, APYs to your large-give deals accounts features generally risen.